Retail Industry Challenges and Opportunities in 2024

As we enter 2024, the retail landscape finds itself at a crossroads. It grapples with a myriad of challenges, including tightened regulations on consumer privacy and sustainability. The lingering effects of COVID-19 and other global crises add to the complexity. Retailers must navigate this intricate web to adapt and thrive in the evolving market environment. But innovation follows adversity, and we predict that 2024 will be a turning point for retail businesses that embrace AI and automation, explore new forms of marketing, and prepare their businesses for success in a circular economy. In this blog, we delve into key hurdles facing the retail sector in 2024 and examine the innovative strategies and emerging trends poised to reshape the industry.

6 challenges for the retail industry in 2024

Privacy and cybersecurity

Consumer data collection through third-party cookies has been a key strategy for businesses for many years. This data allows companies to make informed decisions that save resources, improve product quality, enhance the customer experience, and create innovative marketing strategies. Practically, it also allows companies to personalise the customer experience, products and services, collect payments and deliver products. Consumers are becoming more cautious about the data they provide companies, regardless of the level of trust. When Apple introduced App Tracking Transparency (ATT) with iOS 14.5 in 2021, users were allowed to prevent apps from tracking their activity, which would give companies data to deliver personalised ads. A majority of users opted out of app tracking, reducing the share of trackable Apple traffic in the United States alone by 55 per cent. This translated to a 21 per cent fall in ad revenue from Apple users for publishers. However, more consumers (around 74 per cent, according to Salesforce) are recognising that providing data to companies may get them better service and more personalisation. Overall, customers are more willing to give away their data when given a clear explanation of how the data will be collected, used and stored. Third-party data is out - in 2024, first-party data will be a key asset.

As companies collect more data on their customers, security should be a top priority. There has been a rapid increase in cybercrime since 2020, with a 435 per cent increase in ransomware alone over that year. Identity fraud makes up over 71 per cent of ecommerce cyberattacks, while businesses lost over $100 billion in 2023 to fraudulent chargebacks. As technology improves and more brick-and-mortar stores transition online, businesses need to keep retail employees abreast of the latest cybercrime methods and cybersecurity measures through ongoing training. For more information on the cost of cybercrime, check out our blog “7 Common Types of Ecommerce Fraud and How to Prevent Them”.

Cost of living and consumer confidence

The last few years have been expensive for both consumers and businesses. One of the main reasons for these price hikes includes the 2022 Russia-Ukraine war, which had a knock-on effect of increasing food and fuel prices globally. Housing and rental prices have also hit consumers hard, with rentals in short supply and high demand. Finances in the average household have been speeding backwards, with household savings at near 16-year lows of 1.1 per cent. According to a survey by NIQ, the top three concerns among global consumers are rising food prices (36 per cent), the increasing cost of utilities (19 per cent) and economic downturn (17 per cent). Consumer habits have changed as a result, with many consumers pivoting to budget-friendly home brands, though some consumer preferences remain the same: 47 per cent of customers still prefer shopping for well-known and trusted brands, while 30 per cent are opting for high-quality items that are more expensive but will last longer. Thankfully, data suggests prices are coming down, with the Reserve Bank of Australia’s Consumer Price Index (CPI) rising 4.9 per cent over 12 months between October 2022 and 2023 - down from the 5.6 per cent increase in September. Time will tell if these rates continue to decrease throughout the year.

Consumer confidence is an economic indicator describing the degree of optimism consumers have about the state of the economy. At its simplest, high consumer confidence indicates high consumer spending, consumption and economic growth, while low consumer confidence indicates a lack of spending, purchasing power and growth. Despite experiencing the biggest CCI monthly gain since April last year, sentiments are still firmly pessimistic about consumer behaviour going into 2024. The Inside Retail Australian Retail Outlook 2024 states that 63 per cent of retailers consider consumer confidence the biggest challenge retailers will face coming into 2024. Although much of consumer confidence can’t be controlled by businesses, brands can take steps to increase consumer confidence such as fostering brand loyalty, building a strong reputation and remaining honest and transparent.

High shopper expectations

Despite the myriad of issues that have plagued global supply networks, customer demands and expectations are higher than ever. The Shopify Commerce Trends 2023 Report noted that consumer demands were not waiting for supply chains to recover, and they don’t seem to be easing up in the face of rising costs either. One of the biggest retail trends coming into 2024 will be personalisation. According to the Salesforce State of the Connected Customer (6th edition), 65 per cent of customers expect companies to adapt to their changing needs and preferences, but 61 per cent believe companies only treat them as a number and not an individual. Customers also expect a seamless shopping experience and consistent communication across various channels, with 74 per cent of customers expecting to be able to do anything online that they could do over the phone or in person. This year, brands should embrace technology to deliver faster, more personalised experiences across all sales channels.

Sustainability demands

For years, consumers have been increasingly dedicated to sustainability. Now, more than 77 per cent of consumers want brands to provide more information about their sustainability efforts. In addition, 85 per cent of consumers globally feel brands need to take responsibility for their environmental impact, and 67 per centof Australians are demanding they reverse the damage caused. Consumers, regulators and investors alike are demanding more disclosure and transparency. Businesses that don’t adapt are not only risking the goodwill of consumers, but they will also face increasing physical climate risks (the financial impacts of which are set to double from the 2050s to the 2090s) and regulatory consequences. Studies show that at least eight of ten consumers are willing to pay up to 5 per cent more for sustainably produced goods, and 41 per cent are willing to wait longer for sustainable delivery.

Increasing competition

Months into the COVID-19 pandemic, online shopping shot up by 77 per cent year over year, accelerating the development of ecommerce by at least half a decade (Shopify Commerce Trends 2023). Now, most businesses are online in some capacity, whether they operate an online store or have a social media presence. The lines are further blurred by the development of social commerce, where businesses are now selling directly to consumers through their social media feed. Inside Retail states in their 2024 Retail Outlook Report:

“...ecommerce has now matured from a high-growth channel with room for all to benefit to a largely level playing field on which retailers will have to battle each other for market share”.

It’s more important than ever for both new and established retailers to keep up with market trends, adopt an omnichannel approach to their marketing efforts, and embrace social commerce channels to remain competitive.

Volatile supply chains

Pandemics and political disruptions aren’t the only threats to the supply chain in 2024. Extreme weather and geopolitical tensions are the top concerns this year. We are already seeing disruptions from drought conditions at the Panama Canal, attacks on commercial ships in the Red Sea, and unpredictable weather patterns in the Americas. Supply chains are also being hit with increased environmental regulations, raw material shortages, a rise in targeted cyberattacks and other issues that will continue to plague them throughout the year and potentially beyond. This will affect many retailers in several ways, from product sourcing to shipping. Struggling businesses may benefit from alternative fulfilment options to meet demand during this time, such as third-party logistics or dropshipping with Dropshipzone.

6 opportunities for the retail industry in 2024

Embrace AI and automation

AI already plays a crucial role in more than 2-in-5 businesses in Australia, and this number will continue to increase in 2024. This goes beyond just ChatGPT - generative AI can aid retailers with inventory management, accurately forecast demand, deliver compelling promotions, assist customer service agents with customer queries, actively monitor consumer behaviour and optimise freight routes. 77 per cent of executives believe AI will have the biggest impact on their business over the next 3-5 years, yet only 23 per cent of surveyed consumer and retail organisations have appointed a central person or team to organise the response to the emergence of generative AI.

While AI and automation are independent processes, they have similar goals. Automation involves creating robots following pre-defined rules to perform tedious, repetitive, or error-prone tasks. AI involves creating robots that think for themselves and make decisions based on human input. Using AI with automation allows businesses to free up human resources and create a dynamic workflow. This can help combat unpredictable supply chain disruptions and help businesses meet the high expectations of customers. It will be important for businesses to retire outdated technology, close the digital skills gap through education and explore the exciting opportunities that new technologies can bring for business growth.

Optimising for omnichannel distribution

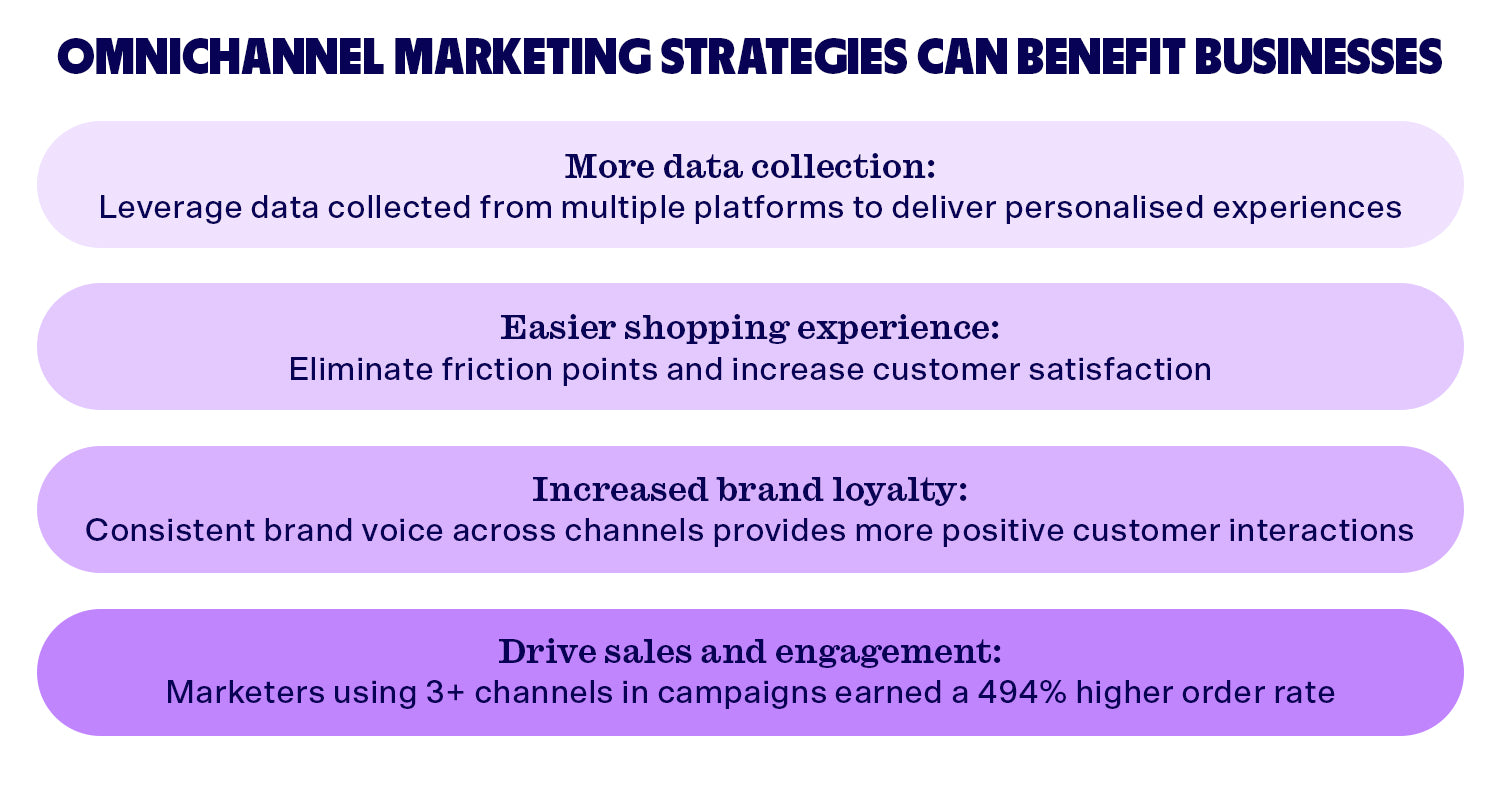

Omnichannel distribution refers to the practice of engaging with an audience consistently across multiple media channels. For ecommerce, this means not only keeping your brand voice consistent across multiple social media channels but also providing customers with a seamless shopping experience whether they access your store from your social media or main website, both on desktop and on mobile. Omnichannel marketing strategies can benefit businesses in a variety of ways:

-

More data collection: Businesses can leverage data collected from multiple platforms to create personalised experiences for their customers, measure KPIs, and discover potential new markets.

-

Easier shopping experience: By eliminating friction points and giving customers more options to shop, brands can increase customer satisfaction.

-

Increased brand loyalty: Maintaining a consistent brand voice across channels and providing a seamless shopping experience means more positive customer interactions, which helps foster brand loyalty.

-

Drive sales and engagement: In research conducted by Omnisend in 2022, marketers using three or more channels in a campaign earned a 494 per cent higher order rate than those using a single-channel approach. For omnichannel campaigns that used push notifications, this jumped to a whopping 614 per cent.

With social commerce taking off, it’s never been more important for retail companies to reach customers where they are. For businesses in 2024, the keys to a successful omnichannel strategy will be comprehensive market research, data analysis and tech integration.

Circular economies

In a linear economy, goods are produced, used, and thrown away. In a circular economy, goods are kept in circulation as long as possible through recycling, repair, refurbishment, redistribution and remanufacturing, leaving minimal waste at the end of a product’s journey. These products are developed with future value in mind, which includes ongoing support and a continuous cycle of use and reuse. With sustainability high on the agenda for both consumers and governments, now is the perfect time for brands to invest in circular strategies. These might include partnering with suppliers who have a circular business model, reselling or recycling returned items or using reusable or compostable packaging. By participating in a circular economy, brands can help to slow natural resource depletion and biodiversity loss, reduce carbon emissions, create jobs, and ease the burden on consumers’ wallets - as well as develop their brand loyalty.

Experiential retail

Experiential retail focuses on creating memorable experiences for customers, not only selling. The idea is to provide a unique, immersive and memorable shopping experience that allows brands to build a deeper relationship with consumers. While experiential retail in ecommerce may require some out-of-the-box thinking compared to physical stores, with the help of technology and a killer content strategy, online retailers can deliver incredible experiences at the click of a button. For instance, virtual showrooms can replicate the in-store customer experience while of browsing, while AR and VR technology can place digital pieces directly in your home. Some brands offer a try-on system, where customers can take a photo and digitally apply makeup, clothing or other accessories to their avatars. Another popular customer experience is live shopping, where customers can watch businesses manufacture, pack or showcase their products. These live streams often have an interactive element, allowing viewers not only to comment but participate in games, challenges, exclusive deals or giveaways. Research indicates that 72 per cent of shoppers made a purchase during a live shopping event, and the live shopping market is expected to reach $129.6 billion in 2024, with China accounting for the largest market share. Brands wanting to offer memorable experiences will need to leverage data to personalise their branded experiences, stay up to date with technological advances and continually look for ways to engage their target audience.

Gen Alpha and the Metaverse

Although Gen Alpha (those born between 2010 and 2024) are still considered children without purchasing power, brands are realising that this generation develops strong brand preferences at an early age. It’s estimated that more than $5.39 trillion will be spent on Gen Alphas by the end of 2024, far outpacing millennials and Gen Z. This rapid pace of brand adoption has been attributed to greater internet accessibility, accelerated by the pandemic. Technology is central to Gen Alpha’s identity, with 63 per cent valuing the latest technology over Gen Z’s 31 per cent. As this generation comes of age, their seamless integration into the Metaverse - a collective virtual space comprising augmented and virtual reality environments - presents both challenges and opportunities for retailers. With Gen Alpha's innate digital fluency and penchant for immersive experiences, the Metaverse offers retailers a tantalising playground for innovative marketing concepts.

Retail media networks

A retail media network is an advertising platform that retailers set up, allowing themselves and other brands to advertise to customers across multiple channels including on their website, apps, or in-store. These networks are making waves as a new way to profit in a world phasing out third-party data. Increasing concerns over privacy and cross-site tracking have led Google to phase out third-party cookies by the second half of 2024, which will have a massive impact on marketers who rely on cookies for data collection. In their place, retail media networks have stepped up to the plate. With these platforms, retailers can collect first-party data from customer interactions and transactions and then use that data to deliver dynamic, highly personalised advertising. Brands can use retail media networks to maximise their reach across multiple channels and accurately measure and optimise their advertising efforts for maximum Return on Ad Spend (ROAS). Major Australian retailers such as Woolworths and David Jones have already jumped on the bandwagon, establishing their own retail media businesses. Brands that work together with these businesses are more likely to weather the rough times to come in the post-third-party-data world.

Summary for the year ahead

Although almost four years have passed since the initial global lockdowns, the repercussions of the COVID-19 pandemic and other disasters continue to ripple across the supply chain and beyond. Amidst rising living costs and dwindling consumer confidence, retailers must find innovative ways to retain customer trust and adapt to heightened shopper expectations. Sustainability demands further complicate the landscape, compelling businesses to embrace transparency and eco-friendly practices. However, economists are predicting that we will finally turn it around in 2024. Despite these obstacles, growth opportunities abound, especially through the adoption of AI and automation, optimisation of omnichannel distribution, and commitment to circular economy principles. Embracing experiential retail and leveraging retail media networks offer additional avenues for differentiation and revenue generation. By navigating these challenges and seizing opportunities to stay ahead, retailers can forge a resilient path forward in the dynamic landscape of 2024.